Why are brands that are doubling down on local retail winning DTC too?

For many brands, the promise of direct-to-consumer (DTC) commerce sounds like a dream come true: control your margins, control customer data, and control messaging—all without the perceived “middleman” of traditional retail. But as tempting as this shortcut might appear, it almost always comes with steep, long-term consequences.

The offline channel — brick-and-mortar retail — remains an enormous (and sometimes underappreciated) source of brand awareness. When brands attempt to undermine or bypass the online-to-offline journey, they risk damaging the far more common offline-to-online flow that supports their overall sales funnel. Why does this happen? What is a better solution?

The Symbiotic Relationship of Online and Offline

“Online-to-Offline” shopping typically means consumers research a product online but for one reason or another prefer to complete their purchase in a physical store.

“Offline-to-Online” shopping is when consumers discover a product in a store and buy later through an online channel — often a brand’s site.

Most retailers understand that these two flows feed into each other. When an enthusiastic shopper first discovers a product at their favorite store, that shopper might:

Buy Immediately in the Store – The instant sale is a clear short-term win.

Research Online, Then Purchase Later – The “second touch” might be on your own DTC site, which effectively secures a sale that may not have happened without that initial, in-person discovery.

Become a Repeat Customer - Once a shopper experiences multiple, positive brand engagements, they are far more likely to become a multi-channel shopper who uses physical and digital sales channels to make future purchases.

But, when brands aggressively prioritize DTC over wholesale or brick-and-mortar partnerships, they threaten to reduce or entirely remove that in-person discovery funnel. That means fewer people are organically exposed to the brand in physical stores, which drives fewer people to the brand’s website—which often leads to a drop in sales across all channels.

The Danger of Alienating Retail Partners

The Importance of Presence

Local shops often serve as a brand’s launch pad. Shoppers visiting a store may not only discover a new product but are also likely to develop a certain level of trust: “If my favorite local shop is carrying this new brand, it must be good.” The presence alone is a form of implicit endorsement by a trusted local expert.

When brands push too hard on DTC, they may use tactics that directly undercut their retail partners — for example, offering “customer acquisition” discounts or product exclusivity, or diverting marketing budgets away from in-store initiatives to focus solely on digital campaigns. Or, in the worst case, violating their own MAP policies. Retailers notice these moves, and in response:

They trim (or completely remove) that brand from their shelves.

They respond in kind with their own aggressive discounts.

They give more shelf space and endorsement to competing brands.

By alienating retailers, brands remove themselves from one of their most powerful channels for brand discovery and trust-building, leading to decreased brand enthusiasm.

The Ongoing Dominance of Physical Retail

There’s a widespread misconception that e-commerce has already overtaken brick-and-mortar. But while online sales continue to grow, the reality is that physical retail remains the dominant channel and will likely remain so for decades to come.

According to the U.S. Census Bureau, e-commerce represented around 14.3% of total U.S. retail sales in 2022—meaning over 85% of retail still happened in physical stores.

Statista projects that, worldwide, e-commerce may grow to around 20.7% of total retail sales by 2027, leaving more than three-quarters of all sales to physical channels.

For the foreseeable future, brick-and-mortar retail will remain the largest opportunity for brand discovery, research, and immediate purchase. Undermining local market share or store relationships in a bid for higher margin DTC is filled with unintended consequences.

Plus, Large Online Marketplaces Dominate Online

Another important factor is the nature of online retail itself. The vast majority (over 60%) of e-commerce revenue is controlled by large marketplaces — platforms that attract enormous traffic and offer infinite shelf space, but also fierce competition:

If you’re focusing entirely on your own branded DTC site, you’re instantly competing with these marketplaces for customer attention.

Many shoppers, even after discovering your product, may choose to check these larger marketplaces for deals, reviews, or faster shipping.

Simply put, going DTC-exclusive without a strong physical presence is akin to betting your entire brand on a smaller share of the total e-commerce pie — while battling giants who set the pace on shipping, pricing, and customer expectations.

Why Brands Need to Nurture the Offline-to-Online Flow

Despite all the hype around “omnichannel,” many companies still operate online and offline strategies as separate silos with separate business units competing against each other. But the most successful modern brands think in terms of cross-pollination:

Physical Retail as a Discovery Engine

Brands that show up in brick-and-mortar stores gain visibility with local shoppers who may never have found them online. This is a funnel that leads to website visits (and repeat online purchases).

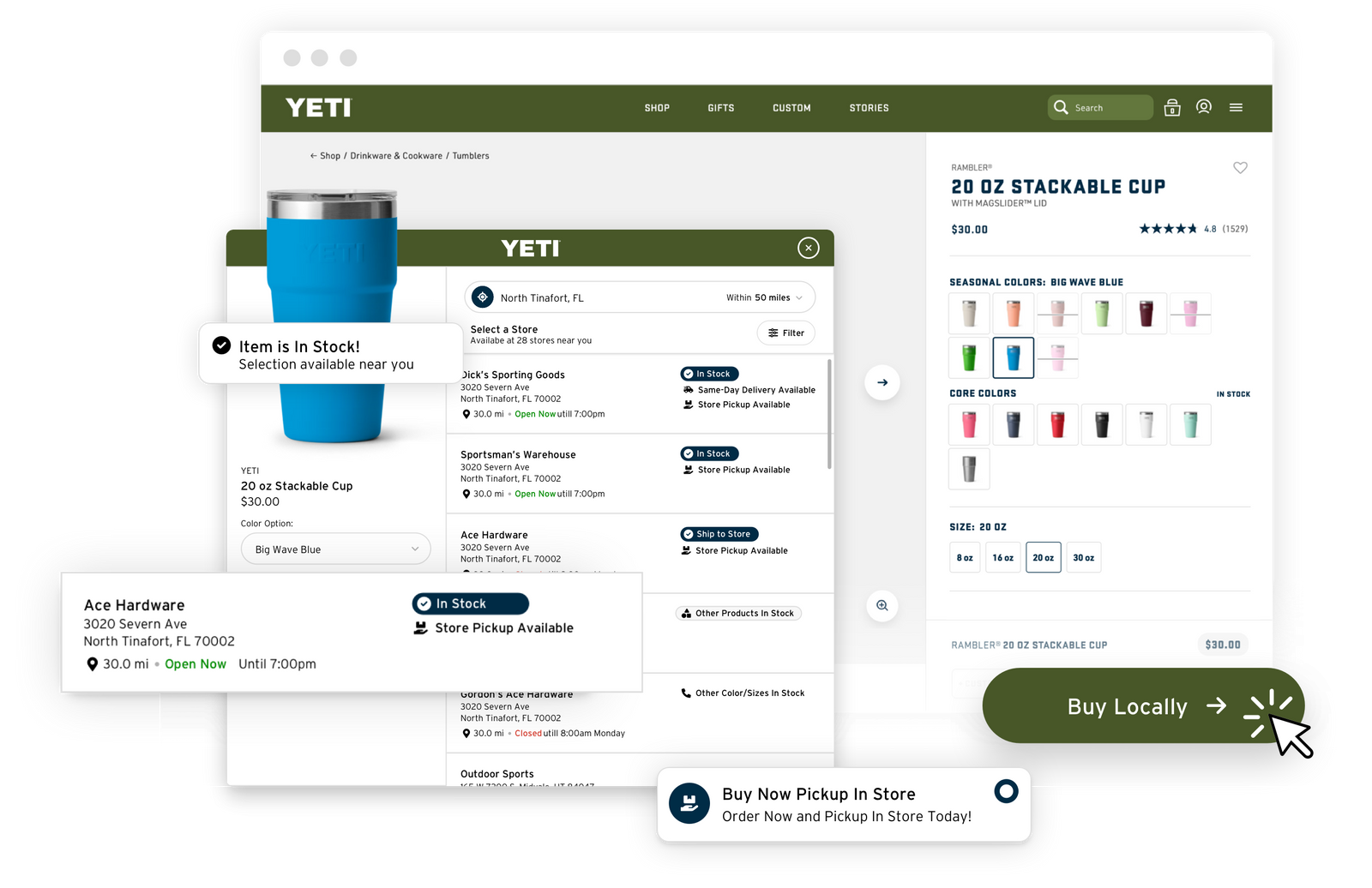

Online Support for Offline Partners

Conversely, brands can support their retail presence by driving online awareness of in-store availability like:

The Path Forward: Balancing DTC with Retail Partnerships

If you’re a brand leader looking to grow sustainably, consider these strategies:

Bridge the Online-Offline Gap

Integrate inventory and the most information from local stores into your website. Encourage shoppers to visit local stores for events, demos, or services. Use your digital platform to strengthen the local retail experience, rather than undermine it.

Local Market Development & Co-Op Ads

Work with your retail partners on ads that direct customers to buy specific products or categories nearby. Use targeted email, search, and social promotions that drive local shopping for your brand.

Leverage Data to Support Retail Demand

Work with stores to combine inventory, sales, and demand insights - which products are trending locally - enabling them to assort and promote items likely to sell well in their stores. This “win-win” approach boosts sell-in and sell-through.

Offline + Online

vs

Online - Offline

Brands that want to stay visible and thrive need to approach all channels with a coherent, shopper-centric optimization strategy. Win support from physical retail, by respecting the online-to-offline journey. It’s not about shoppers choosing wholesale or DTC — it’s about understanding how each channel reinforces each other.

Physical Retail will continue to dominate total retail sales for decades, creating the lion’s share of brand discovery.

Online Marketplaces make direct competition fierce and can overshadow a purely DTC approach.

True Synergy between the channels allows a brand to capture maximum consumer interest, maintain goodwill with retailers, and feed an ongoing cycle of mutual growth.

Rather than see brick-and-mortar relationships as a low-margin ad hoc channel, forward-thinking companies treat them as an irreplaceable pillar of a unified business strategy.